Give the Gift of Choice!

Too many options? Treat your friends and family to their favourite stores with a Bayshore Shopping Centre gift card, redeemable at participating retailers throughout the centre. Click below to purchase yours today!Purchase HereHome

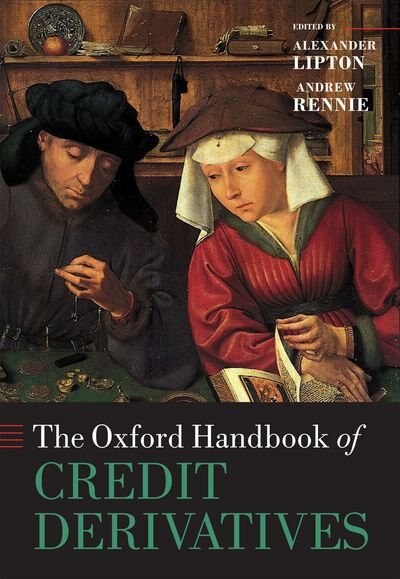

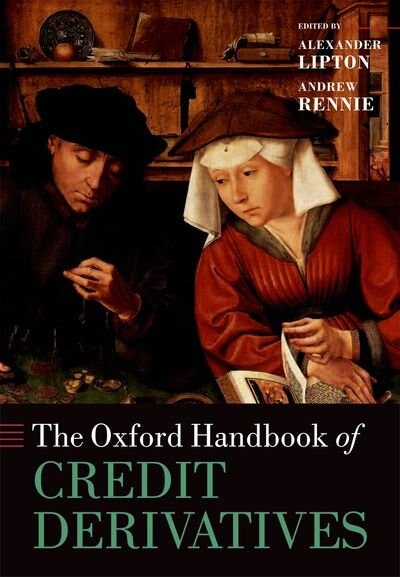

The Oxford Handbook of Credit Derivatives by Alexander Lipton, Paperback | Indigo Chapters

Coles

Loading Inventory...

The Oxford Handbook of Credit Derivatives by Alexander Lipton, Paperback | Indigo Chapters in Ottawa, ON

From Alexander Lipton

Current price: $124.50

From Alexander Lipton

The Oxford Handbook of Credit Derivatives by Alexander Lipton, Paperback | Indigo Chapters in Ottawa, ON

Current price: $124.50

Loading Inventory...

Size: 25.4 x 246 x 1238

*Product information may vary - to confirm product availability, pricing, shipping and return information please contact Coles

From the late 1990s, the spectacular growth of a secondary market for credit through derivatives has been matched by the emergence of mathematical modelling analysing the credit risk embedded in these contracts. This book aims to provide a broad and deep overview of this modelling, coveringstatistical analysis and techniques, modelling of default of both single and multiple entities, counterparty risk, Gaussian and non-Gaussian modelling, and securitisation. Both reduced-form and firm-value models for the default of single entities are considered in detail, with extensive discussion of both their theoretical underpinnings and practical usage in pricing and risk. For multiple entity modelling, the now notorious Gaussian copula is discussed with analysisof its shortcomings, as well as a wide range of alternative approaches including multivariate extensions to both firm-value and reduced form models, and continuous-time Markov chains. One important case of multiple entities modelling - counterparty risk in credit derivatives - is further explored intwo dedicated chapters. Alternative non-Gaussian approaches to modelling are also discussed, including extreme-value theory and saddle-point approximations to deal with tail risk. Finally, the recent growth in securitisation is covered, including house price modelling and pricing models forasset-backed CDOs. The current credit crisis has brought modelling of the previously arcane credit markets into the public arena. Lipton and Rennie with their excellent team of contributors, provide a timely discussion of the mathematical modelling that underpins both credit derivatives and securitisation. Thoughtechnical in nature, the pros and cons of various approaches attempt to provide a balanced view of the role that mathematical modelling plays in the modern credit markets. This book will appeal to students and researchers in statistics, economics, and finance, as well as practitioners, credittraders, and quantitative analysts | The Oxford Handbook of Credit Derivatives by Alexander Lipton, Paperback | Indigo Chapters

From the late 1990s, the spectacular growth of a secondary market for credit through derivatives has been matched by the emergence of mathematical modelling analysing the credit risk embedded in these contracts. This book aims to provide a broad and deep overview of this modelling, coveringstatistical analysis and techniques, modelling of default of both single and multiple entities, counterparty risk, Gaussian and non-Gaussian modelling, and securitisation. Both reduced-form and firm-value models for the default of single entities are considered in detail, with extensive discussion of both their theoretical underpinnings and practical usage in pricing and risk. For multiple entity modelling, the now notorious Gaussian copula is discussed with analysisof its shortcomings, as well as a wide range of alternative approaches including multivariate extensions to both firm-value and reduced form models, and continuous-time Markov chains. One important case of multiple entities modelling - counterparty risk in credit derivatives - is further explored intwo dedicated chapters. Alternative non-Gaussian approaches to modelling are also discussed, including extreme-value theory and saddle-point approximations to deal with tail risk. Finally, the recent growth in securitisation is covered, including house price modelling and pricing models forasset-backed CDOs. The current credit crisis has brought modelling of the previously arcane credit markets into the public arena. Lipton and Rennie with their excellent team of contributors, provide a timely discussion of the mathematical modelling that underpins both credit derivatives and securitisation. Thoughtechnical in nature, the pros and cons of various approaches attempt to provide a balanced view of the role that mathematical modelling plays in the modern credit markets. This book will appeal to students and researchers in statistics, economics, and finance, as well as practitioners, credittraders, and quantitative analysts | The Oxford Handbook of Credit Derivatives by Alexander Lipton, Paperback | Indigo Chapters